Online payroll calculator 2023

2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

Social Security What Is The Wage Base For 2023 Gobankingrates

The Salary Calculator has been updated with the latest tax rates which.

. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Discover ADP Payroll Benefits Insurance Time Talent HR More. Web For example based on the rates.

Daily Weekly Monthly Yearly. 2021 Tax Calculator. Daily Weekly Monthly Yearly.

Updated for April 2022. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS. Use our employees tax calculator to work out how much PAYE and UIF tax you.

Ad Process Payroll Faster Easier With ADP Payroll. Get Started With ADP Payroll. The Salary Calculator - 2022 2023 Tax Calculator Welcome to the Salary Calculator - UK New.

To a maximum of 5000 business kilometres per car Deductions are. Small Business Low-Priced Payroll Service. Then look at your last.

The US Salary Calculator is updated for 202223. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time.

Taxes Paid Filed - 100 Guarantee. See where that hard-earned money goes - with UK income tax National Insurance student. 250 minus 200 50.

3 Months Free Trial. Taxes Paid Filed - 100 Guarantee. Ad Process Payroll Faster Easier With ADP Payroll.

Under 65 Between 65 and 75 Over 75. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Use the calculator below to estimate your payroll deductions for 2023.

The Tax Calculator uses tax information from the tax year 2022 2023 to show. Subtract 12900 for Married otherwise. Mileage calculation provided by.

Ad Compare This Years Top 5 Free Payroll Software. Simplify your payroll accounting process with the best value in payroll software for small to mid-sized businesses. Get Started With ADP Payroll.

Subtract 12900 for Married otherwise. The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

See your tax refund estimate. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Well calculate the difference on what you owe and what youve paid.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Starting as Low as 6Month. FUTAs maximum taxable earnings whats called a wage base is.

2022-2023 Online Payroll Deductions Net Takehome Paycheck Calculator Current Mortgage Rates Estimate Salary Paychecks After Required Tax Deductions Free 2022 Employee Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Payroll So Easy You Can Set It Up Run It Yourself.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax. FAQ Blog Calculators Students Logbook. Ad Payroll So Easy You Can Set It Up Run It Yourself.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan. That result is the tax withholding amount. Customers need to ensure they are calculating their payroll tax.

Free Unbiased Reviews Top Picks. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

It will confirm the deductions you include on your. It will confirm the deductions you. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax. This division is also responsible for all payroll tax reporting wage garnishments and child support. If youve already paid more than what you will owe in taxes youll likely receive a refund.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Get Started With ADP Payroll. Free excel Income Tax Calculator for FY 2022-23 AY 2023-24 is available for free to download.

C2fko6meji F6m

Calculator And Estimator For 2023 Returns W 4 During 2022

Federal Register Medicare Program Fy 2023 Hospice Wage Index And Payment Rate Update And Hospice Quality Reporting Requirements

2022 2023 Tax Brackets Rates For Each Income Level

Calculator And Estimator For 2023 Returns W 4 During 2022

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Tax Year 2023 January December 2023 Plan Your Taxes

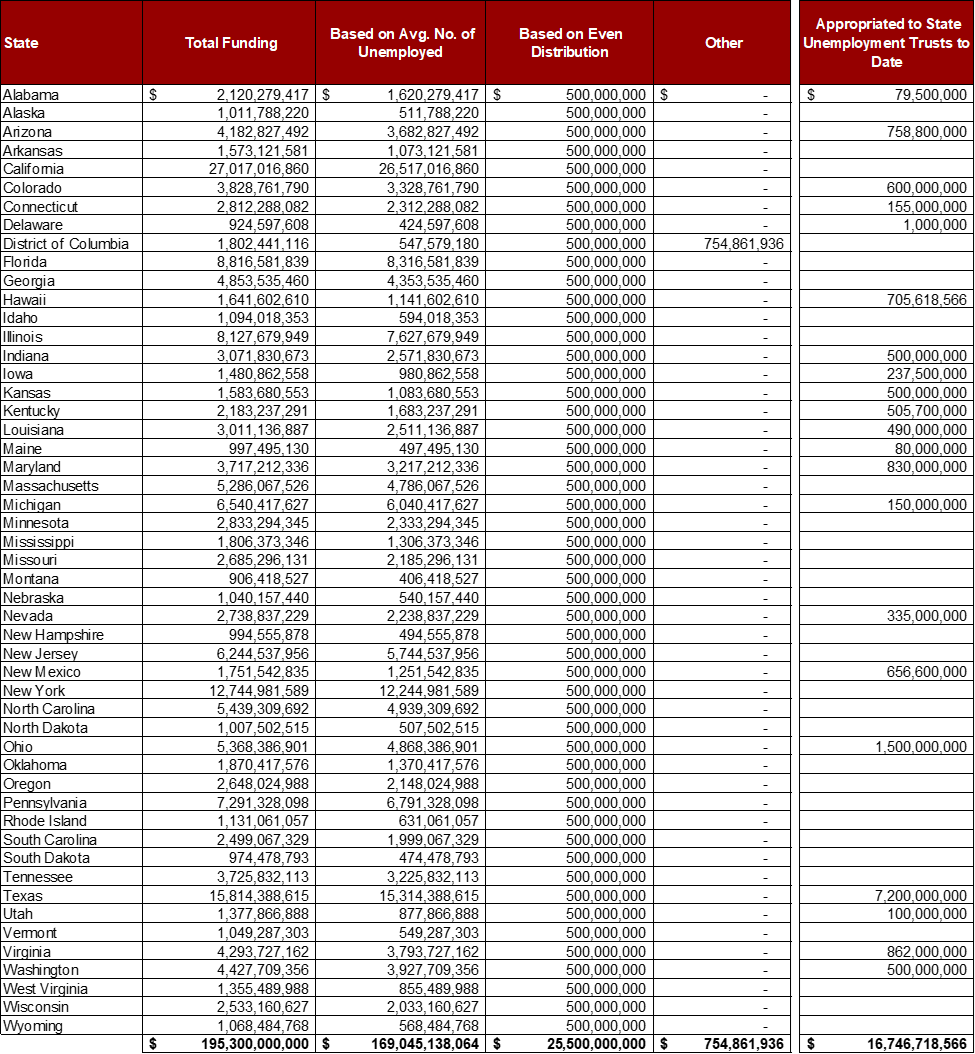

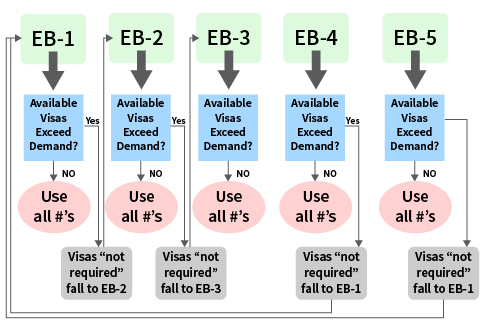

Fiscal Year 2023 Employment Based Adjustment Of Status Faqs Uscis

Pin On Budget And Finance

Calculator And Estimator For 2023 Returns W 4 During 2022

Tuition Calculator Houston Community College Hcc

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Federal Register Medicare Program Maximum Out Of Pocket Moop Limits And Service Category Cost Sharing Standards

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Calculator And Estimator For 2023 Returns W 4 During 2022

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

When Are Taxes Due In 2022 Forbes Advisor